A bright fintech company once stood in a busy Southeast Asian city, ready to transform how people manage their finances. Armed with a state-of-the-art app, the founders wanted to make investing, saving, and budgeting more effortless.

Excitement was in the air as they introduced their fintech app to the competitive market.

However, it was quickly discovered that customer acquisition and engagement were easier achieved than planned:

- Diverse Demographics: The region’s mixed demographic makeup presented the first obstacle. The app did well among tech-savvy urbanites, but it had trouble connecting with older people and people living in rural areas with less experience with digital financial tools.

- Limited Digital Literacy: Despite the growing trend of digital use, certain demographic groups exhibited low levels of digital literacy. Most customers were reluctant to give their financial information to a relatively new competitor in the market, even with robust security procedures in place.

- Competition from Traditional Players: Due to ingrained traditional banking systems and other fintech behemoths in many Southeast Asian nations, it became challenging for fintech apps to convince consumers to switch to digital alternatives.

The fintech app soon realised they had to change course in a way that’d make their potential customers want to place their trust in their app and services. A means for their users to choose their fintech app in exchange for something worth engaging with them.

That’s when their team huddled, and guess what was born out of their huddle hurrah? Gamification!

After extensive research, they concluded that gamification would be one of the most economical, effective, and proven ways to acquire, engage, and retain customers for their fintech app in Southeast Asia.

Let’s tell you how it all happened.

Step 1: Understanding the Financial Digital Ecosystem in Southeast Asia

Before deciding whether to leverage gamification to grow their fintech app usage, the team wanted to determine whether there is a digital market space that fintech gamification can fit into.

- Mobile Penetration and Smartphone Adoption: There’s been a noticeable surge in the use of smartphones and mobile phones in Southeast Asia. This has benefited fintech companies since it has allowed them to reach a larger audience and offer financial services through mobile apps.

- Rapid Development of Digital Payments: As cashless transactions become more common, the ecosystem for digital payments has increased. Mobile wallets like GrabPay and GoPay, which offer convenient and safe payment methods, have become essential in the modern world.

- Neobanks and Digital Banking: Fintech businesses like Tonik (Philippines), Aspire (Singapore), and Jenius (Indonesia) that offer digital banking services and effective financial solutions have become disruptive.

- Innovations in Insurtech: The insurance technology industry has made strides in incorporating digital solutions. Insurtech enterprises utilise digital platforms, artificial intelligence, and data analytics to optimise product offerings.

Step 2: Explore Fintech Gamification in Southeast Asia

The team understood that the digital transformation Southeast Asia has experienced over time required innovative customer engagement methods beyond traditional means.

Next, they embarked on a quest to learn if gamification had proven successful for financial companies in Southeast Asia.

Here are 4 companies they came across which finally quenched their curiosity to check how gamification works for the finance landscape in Southeast Asia:

1. MoMo Fintech App Gamification

With more than 23 million active users, MoMo is a popular e-wallet in Vietnam known for its fintech gamification. In 2020, the payment app introduced ‘MoMo Academy’, an interactive knowledge quiz competition.

Ever since, the fintech startup has been a proven example of gamification doing wonders for the fintech industry. Here are some of their fintech gamification strategies.

a. MoMo Bon Bon: Roll a die, drive a car, and win gifts! This was the fintech app gamification strategy MoMo adopted in June 2023. Users had to complete tasks like Transferring money or referring friends to participate.Upon task completion, a die would be unlocked, and players could move their car based on the number of kilometres that appear on the dice. As players moved their car, they could collect gift cards, Stars, Trophies, etc., to qualify for grand prizes.

(Disclaimer: This image is for informational purposes only. Opinions or points expressed represent MoMo’s views

and don’t necessarily represent the official position or policies of Gamize by OGL.)

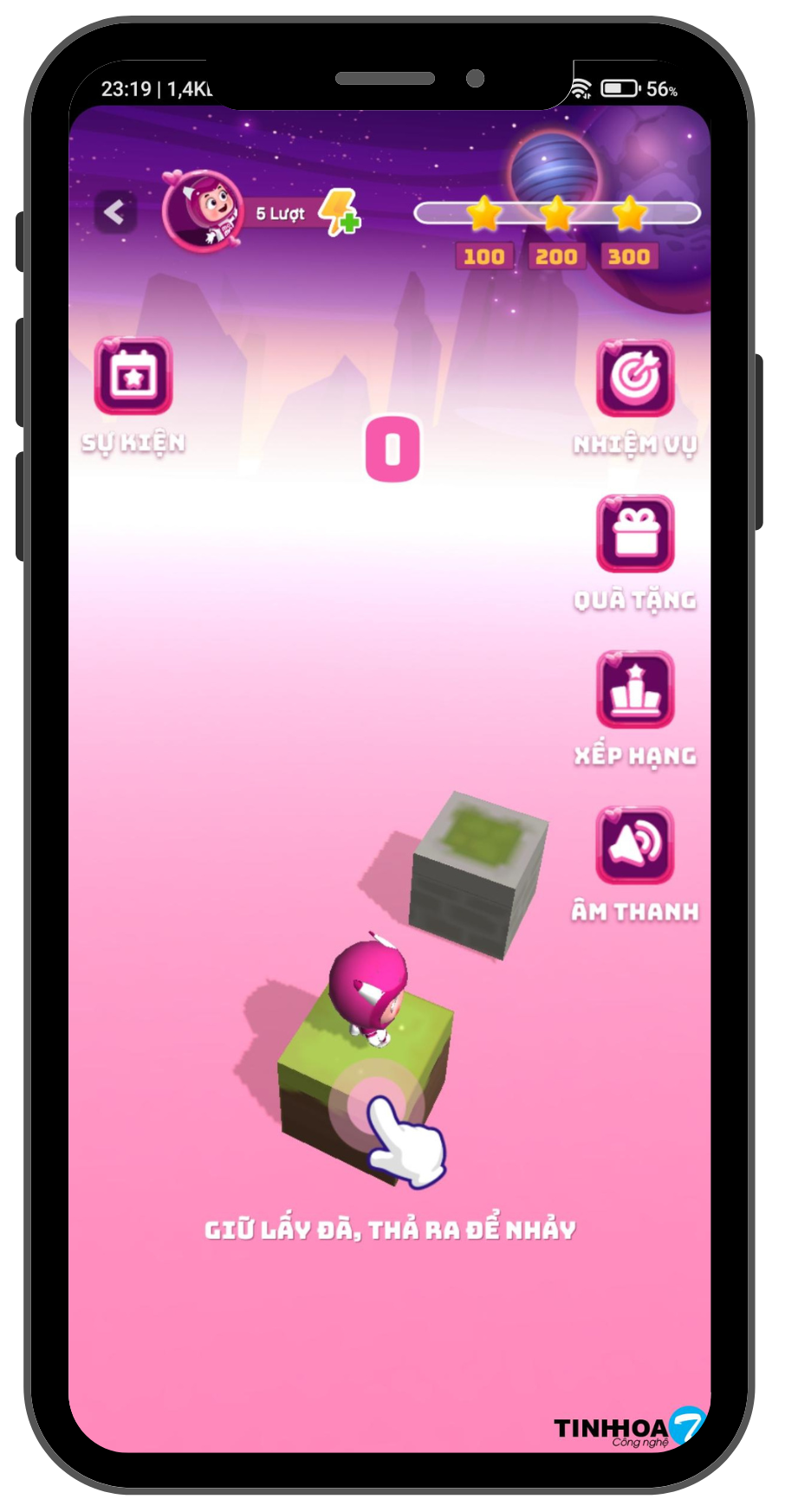

b. MoMo Jump: In October 2021, the MoMo e-wallet launched a ‘Jump to Win Money’ app feature in which players controlled a MoMo character by tapping their screen and making it jump onto boxes.Jumping into the centre of boxes would award players a higher score, reflecting the money they won. Players could play MoMo Jump unlimited times and even win gifts like saving on 3G/4G data cards, bill payments, etc.

(Disclaimer: This image is for informational purposes only. Opinions or points expressed represent MoMo’s views

and don’t necessarily represent the official position or policies of Gamize by OGL.)

c. Silver Billion Fish Pond: As part of their Silver Billion Fish Lake gamification campaign, MoMo challenged players to participate by performing tasks such as scanning bank QR codes, linking bank accounts, etc.Once these tasks were completed, players could collect various Fish types, such as Carp, Partner Fish, Guppies, and Goldfish and use accumulated fish to save on everyday spending or exchange gifts worth up to 200 billion VND.

(Disclaimer: This image is for informational purposes only. Opinions or points expressed represent MoMo’s views

and don’t necessarily represent the official position or policies of Gamize by OGL.)

Must Read: Exploring The World Of Gamification in Southeast Asia in 2024

2. Zalopay Lucky Money Gamification Campaign

Did you know that during the Lunar New Year, people gift each other a bright, beautiful red envelope containing money symbolising luck? But as the pandemic in 2021 raised the need for contactless Lucky Money (Li Xi) transactions, Zalopay, a mobile payment app, came to the rescue.

The payment app developed a gamification feature called ‘Sharable Group Li Xi’ to increase such transactions, encouraging users to share red envelopes on their Zalo group chats.

They also created an in-app game, Li Xi Rain, incentivising users to complete tasks to win more Li Xis.

(Disclaimer: This image is for informational purposes only. Opinions or points expressed represent Zalopay’s views

and don’t necessarily represent the official position or policies of Gamize by OGL.)

As a result, the Zalopay Lucky Money (Li Xi) campaign saw 7.5 million Li Xi shares, 33 million transactions and a 17% hike in brand awareness.

3. ViettelPay Lucky Wheel Gamification Campaign

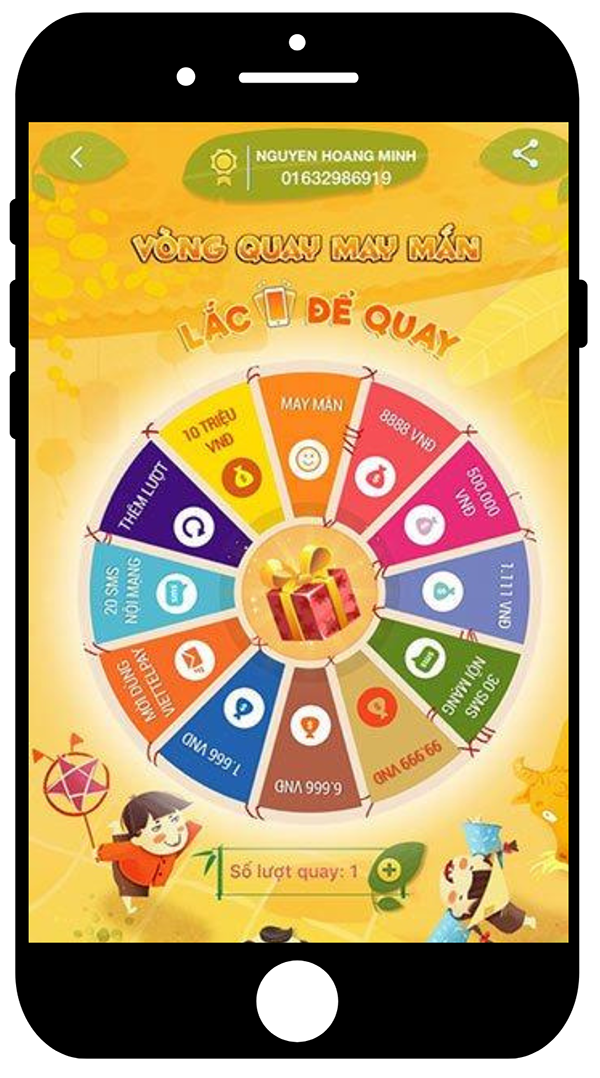

ViettelPay, a payments app by Viettel, launched a ‘ViettelPay Mid-Autumn Festival Lucky Spin’ program in 2018, where users could shake a lucky wheel to win prizes.

Users could visit the ‘Games’ section on the Viettel app and select ‘Lucky Wheel’ to play.

(Disclaimer: This image is for informational purposes only. Opinions or points expressed represent ViettelPay’s views

and don’t necessarily represent the official position or policies of Gamize by OGL.)

Users could then shake to spin the lucky wheel and win cash prizes added to their ViettelPay account within an hour. They could also win up to 10 stars and use it to win random cash rewards up to VND 1,000,000.

The most exciting part is that ViettelPay allowed users to receive one more turn to spin provided they completed actions like inviting friends to ViettelPay or making app transactions like QR code pay, bill payments, etc.

4. UOB City of TMRW Digital Banking Game

United Overseas Bank, a leading Asian bank, decided to encourage savings by launching a gamified expense management game called City of TMRW in 2019.

Customers can start saving and build a virtual city that grows as they save more. Users can unlock more features and rewards as they save money and level up, such as cashback on transactions.

(Disclaimer: This image is for informational purposes only. Opinions or points expressed represent UOB’s views

and don’t necessarily represent the official position or policies of Gamize by OGL.)

Such gamified digital banking experience helped UOB Bank increase Monthly Active Users (MAUs) by 50%, increase online transactions by 60% and reduce Cost Per Acquisition (CAC) by 50%.

Step 3: Gamifying Fintech for Southeast Asia Users

After seeing how gamification had helped financial companies in Southeast Asia improve their customer acquisition, engagement, and retention, the Fintech app finally decided to develop a gamification strategy.

However, the folks did realise the time and technical cost of building a gamification feature from scratch and hence decided to talk to an expert from a gamification software company.

Want to know what happened next and what kind of gamification strategy they brainstormed? Get in touch with Gamize to learn how it ends.